Types of Garage Doors and How They Can Save You Money

Types of Garage Doors and How They Can Save You Money

Installing new garage doors can not only enhance your curb appeal but also cut energy costs during the more extreme months. Some professionals argue that upgrading to newer models has the potential to save families up to a third on their healing and cooling bills. This article will discuss the types of overhead models on the market today that will produce savings as well as aesthetic charm.

Installing new garage doors can not only enhance your curb appeal but also cut energy costs during the more extreme months. Some professionals argue that upgrading to newer models has the potential to save families up to a third on their healing and cooling bills. This article will discuss the types of overhead models on the market today that will produce savings as well as aesthetic charm.

Vinyl ModelsGarage doors constructed of vinyl are possibly the most popular type of overhead model on the market due to its durability and maintenance-free qualities. They are easily paintable but are also available in a variety of colors and decorative patterns. They are the most resistant to dents and dings and are offered in various styles with different upgrades such as windows and decorative glass accents.

Steel ModelsSteel garage doors offer the most cost-effective option in replacing your overhead system. Also very durable, steel models provide years of functionality without sacrificing style. They are available in many styles, patterns and colors as well.

Wood Composite ModelsWood composite is the ‘green’ choice in overhead systems today. This largely recycled material is also very durable and extremely resistant to warping and cracking. Wood composite is very customizable and not as expensive as actual wood, making it a popular choice for do-it-yourselfers who have a precise idea of what they want their overhead model to bring to the styling of their home.

Wood ModelsWood is also a very customizable option. It is often used in more rustic styled homes and creates a lovely warmth, and an organic feel that few other materials can provide. While wood is very versatile, it is not maintenance free, as it requires restraining and sealing at times.

Various Style OptionsOverhead systems are available in many styles, and most styles are offered in any of the above materials. Raised panels create dimension and class, much like recessed panels provide. As stated, windows can add a homier feel to any style, and they are available in numerous options and sizes. The beautiful carriage house styling adds a great deal of drama and panache to any home’s exterior and while the cost is a little higher for these models, you will agree that it is worth every dime.

Whatever style you are planning to use to enhance the beauty of your home, new garage doors are a fantastic place to start. Adding style while saving money is a claim that not many home improvements can make! For more information on how you can begin the upgrade on your home, contact your local overhead system company today.…

Self Storage Facilities – Protecting Your Belongings All The Way

Self Storage Facilities – Protecting Your Belongings All The Way

The Self storage industry is booming with a country like the U.S. having more than forty thousand facilities for self storage. Many causes can account for this sudden boost in the numbers of self storage facilities built to store personal belongings. Millions of people wish to downsize their individual homes and are looking for a place to keep their belongings while others going through a messy divorce have no safe place to store their belongings, so they rent storage space from a self storage company. It is here that self storage units can make a world of difference.

The Self storage industry is booming with a country like the U.S. having more than forty thousand facilities for self storage. Many causes can account for this sudden boost in the numbers of self storage facilities built to store personal belongings. Millions of people wish to downsize their individual homes and are looking for a place to keep their belongings while others going through a messy divorce have no safe place to store their belongings, so they rent storage space from a self storage company. It is here that self storage units can make a world of difference.

Things to Do Before Buying or Renting Self Storage Units:

Before investing in storage units, you need to shop around carefully. Every self storage facility is distinct from another and as a customer you should get exhaustive information about each before finalizing your choice. Such research will help you learn more about the differences in their rent, sizes of storage units, security policies and the like.

*Make a phone call to get information from a self storage unit provider-this is the fastest way to get to know any storage facility’s rates and features. Ideally, make a list of queries you have in mind to avoid wasting time.

*Take a tour of the facility to understand the way storage takes place and meet the storage managers and staff. You can get a first hand idea of the kinds of storage facilities available, both climate-controlled units and standard units.

*Feel free to inquire about the facility’s policies and security clauses.

Storage units have simplified management and assure a regular cash flow, which makes them great for investments along with some extra income options such as late fees. Unlike real estate assets, storage units need lesser maintenance and some owners can provide additional benefits like record storing, free packaging materials, free transport services to a facility, free mailing services, recreational vehicle parking, fax services etc.

Boat storage and car storage have hidden clean up costs that you need to be aware of before entering into any lease with a self storage company. Wine storage helps to enhance the quality of wines over time. Garage storage depends on your garage; you can build some shelves and cabinets for storage purposes. Furniture storage is required for storing excess furniture in facilities that are climate-controlled so there is no damage to your belongings. Without proper RV storage, you may get your RV stolen or damaged. Usually a garage is not large enough to fit it in and without a roof on top or a closed environment, chances are that it will get damaged in harsh weather conditions.

Storage units are usually established in prime locations in close proximity to bus depots, shipyards and airports. The future of this industry is bright especially if you can offer hi-tech facilities to your clients. Impeccable customer service and techniques to improve storage conditions to attract bigger clients are helping some self …

Why Researching Your Garage Door Opener Is A Brilliant Idea

Why Researching Your Garage Door Opener Is A Brilliant Idea

Everything you need to know about researching a garage door opener that lasts. Learn tips to decipher specifications, software, instructions, programming, reviews, and other helpful resources.

Everything you need to know about researching a garage door opener that lasts. Learn tips to decipher specifications, software, instructions, programming, reviews, and other helpful resources.

Specifications — What are they and what do they really mean?

A specification sheet, or spec sheet, gives buyers a snapshot of the opener. Unfortunately, the information is typically displayed in a graph or table that isn’t very easy to read. What happens is that most consumers simply skip over these details because it looks too technical.

Why this is worth researching: Important things like part numbers, how to mount the device, motor speed and type, power cord length, and electric wattage are normally included.

Tip: Write down a list of your own specs before researching the product — it will make reading the chart easier.

Software vs. hardware: The basics

While all openers use some type of hardware to operate, only some require the use of software. For those that do, the software is used to program features like automatic locking, home security integration, and intercoms.

Why this is worth researching: Software components vary and most require a newer version of Windows to operate smoothly.

Tip: Mac users can look for brands that don’t require software. If that’s not an option, invest in a spare computer that can run Windows or consider downloading a copy of Parallels or VMware Fusion that lets you operate Windows from inside your Mac.

Always Follow the instructions

Plenty of people hate following instructions. Instead, they prefer to figure things out on their own. When it comes to openers, this is not something you want to do. Always follow instructions to ensure safety and the longevity of the unit.

Why this is worth researching: A lot of openers include instructions in the manual for monthly and annual maintenance. These instructions can include things like checking moving parts for signs of corrosion, testing the safety mechanisms, and lubricating the motor. If the opener came with a warranty, these tasks must be performed regularly and adequately. Failure to do so can void the warranty and make buying parts more expensive.

Tip: Use an electronic calendar to schedule reminders for routine maintenance.

Programming made easy

Nearly all openers come with a manual on how to program the unit. Some are relatively simple to install and program. Others are more complicated and require a sequence of steps to get the unit up and running.

Why this is worth researching: Some manuals are more than a hundred pages long! Importantly, some models require altering the dip-switch located in the remote. What takes hours to read in a manual can be accomplished in five minutes or less when learning from someone who has already figured out the tricks.

Tip: Watch video tutorials or read explanations online instead. YouTube (videos) and Ezine (articles) are great places to check for such materials.

Review before buying

Since openers themselves are expensive to ship, it’s better to read …

Some Things to Consider When Buying a Secondary Home

Some Things to Consider When Buying a Secondary Home

If you are in the market for a secondary home in the United Kingdom, chances are you will find something that will suit your budget. The housing market is a buyer’s market these days with the prices of real estate somewhat undervalued especially for housing projects that were caught in the recent global financial crisis. Here are some things to consider when looking for a secondary home:

If you are in the market for a secondary home in the United Kingdom, chances are you will find something that will suit your budget. The housing market is a buyer’s market these days with the prices of real estate somewhat undervalued especially for housing projects that were caught in the recent global financial crisis. Here are some things to consider when looking for a secondary home:

– Paying in Cash. One can get good discounts if one pays in cash. You can actually make a cash offer that may be 30% off the asking price. In this day and age, this offer may be good for the owner to seriously think about it. But before you make the cash offer, find out the value of land in that area. If you go and look at the place, look at some of the “hidden” treasures that may be there. For example, check the plumbing pipes. If you are looking at an old home, sometimes these pipes may be made of copper, which is of great value. Look and see if the owners used Henderson garage doors, which is also of great value as a Henderson garage door is a top quality product.

– Figure out the upkeep of the home. If you are buying a country home that includes the surrounding garden, figure out how much it is going to cost you to maintain the home on a monthly basis. Bigger places mean bigger expenses. Some properties for sale include vast tracts of land which may or may not require upkeep but there are gardens that may require maintenance which can be expensive. You would also want to bring a contractor before you purchase the property to see if there is a need for some repair in the home. You don’t need to go into the nooks and crannies of the place but a contractor would be able to see if the house needs to be fixed up by looking at certain things.

– Look at the future value of the home. If you are buying a home for investment purposes, look at the surrounding areas near the home and see if there are any new homes built. This will show you that more people are investing in that place and there is room for growth in that area. If you are planning to have your home leased out for weekends or for short term leases, then considers the distance to the city, and the amount of investment you would need to refurbish the place. By doing your numbers, you can know the amount of time it would take to recover your investment.…

What To Do on A Snow Day

What To Do on A Snow Day

This winter has seen a sudden rush forward of snowy weather, normally reserved for February to March. This has caused major disruptions with further snow showers to come, more people are absent from work due to not being able to travel. School closures have maybe forced you to be off from work taking hastily arranged holidays.

This winter has seen a sudden rush forward of snowy weather, normally reserved for February to March. This has caused major disruptions with further snow showers to come, more people are absent from work due to not being able to travel. School closures have maybe forced you to be off from work taking hastily arranged holidays.

In order to best maximise your time below some ideas of what to do when snowed in this winter.

Catch up on bill payments especially if you manage your finances through the Internet

Clean and tidy the house, the snow in gives a perfect time to tidy the house for Christmas, and catch up with the wash mountain.

Put up the Christmas decorations? A little early but what better time with the snow falling outside?

Use the time Internet shopping, surf the web and get all those Christmas presents you have been putting off you can use the time to browse to the best offers:-

Of course, everybody would want to give gifts because that is what the Christmas season calls for. However, it does not necessarily mean that you have to spend more than what you can afford.

It really pays to shop around and doubly better when you compare prices. You will never know which items are better priced than the others are when you do not compare their values.

The point here is that you should not be confined to one shopping portal. Try to look for other items, usually in independent stores and specialist retailers, where you can find the best items at a lower price. Due to these stores having lower overheads to offer the best deals.

If you and your partner are both off work why not catch up on some winter me time!

Catch up on all the Sky+ programs you have been missing

Cook dig out those recipe books and see what you can cook up, cooking can be very therapeutic and relaxing

Wardrobe clear out, throw out those old clothes ready for your Christmas wardrobe recycle or take to charity shop in the better weather.…

What Not to Wear to Work – Summer Edition

What Not to Wear to Work – Summer Edition

The great thing about fashion is that everyone has their own flavor, their own style, their own idea of what looks good. However, finding the right fashion in the workplace can be a little trickier, especially if you work in an industry with a strict dress code. Employees who are expected to wear professional attire everyday find that wearing a corporate suit in the summertime challenging, especially when then temperatures are rising and the humidity is sweltering. Summertime may allow tweaks in professional attire that will remain completely acceptable if you know “what not to wear.”

The great thing about fashion is that everyone has their own flavor, their own style, their own idea of what looks good. However, finding the right fashion in the workplace can be a little trickier, especially if you work in an industry with a strict dress code. Employees who are expected to wear professional attire everyday find that wearing a corporate suit in the summertime challenging, especially when then temperatures are rising and the humidity is sweltering. Summertime may allow tweaks in professional attire that will remain completely acceptable if you know “what not to wear.”

Flip Flops: Many companies allow dressier sandals in the workplace; however flip flops are not professional footwear at all. Not only are this rubber shoes too reminiscent of the beach or hanging out at the mall, these also make a very irritating noise when walking through quiet hallways in the office.

Sheer Fabrics: Sheer fabrics are best left for bathing suit cover-ups and dressy evening wear. Although sheer clothing may feel breezy and cool in the middle of a heat wave, they may convey the wrong image and unwanted attention at work. Also, sheer clothing will make you very under dressed in the notorious coldness of most office spaces.

Shorts: Wearing shorts will make your image seem less professional, especially cutoffs and cargos. Some fashion magazines picture women in tailored Bermuda shorts or “city shorts” which may be appropriate in the summer for some office places; use your best judgment. However, a just-above-the-knee skirt will keep you even cooler all while conveying a smart, authoritative image.

Too Much Skin: Low-cut blouses, bared midriffs, mini-skirts and backless tops don’t communicate the right message for a professional workplace. Keep skirts at a modest length and keep the neckline of blouses five-fingertips below the collarbone. There is some controversy whether or not arms should be bared in a professional environment; take cues from your superior to see whether or not a jacket or sweater is worn on top of a sleeveless shirt.

Keep your professional reputation intact on your current job or when interviewing for new jobs by wearing the appropriate clothing for the season. Hot temperatures may call for modifications, but always err on the side of being too conservative. You’ll never feel embarrassed by being a bit overdressed for a meeting than being obviously under dressed.…

The Greatest Of Baltimore Since 1907

Ladies’s Well being is your go-to destination for new workouts, legit nutrition advice and weight loss suggestions, the most recent health information, healthy recipes, and extra. For the times when you are adding meals again into your weight loss plan, take a look at at the very least three totally different meals every day, and provides your self three-4 hours to expertise each one’s effects. However a growing physique of analysis indicates we do not get sufficient from our meals for optimum protection against disease.

Ladies’s Well being is your go-to destination for new workouts, legit nutrition advice and weight loss suggestions, the most recent health information, healthy recipes, and extra. For the times when you are adding meals again into your weight loss plan, take a look at at the very least three totally different meals every day, and provides your self three-4 hours to expertise each one’s effects. However a growing physique of analysis indicates we do not get sufficient from our meals for optimum protection against disease.

Optimal Mobile function is at the core of our health and so a primary trigger for many disease is cellular dysfunction, which arises from two predominant sources: Deficiency—not getting all (or enough of) the nutrients our physique wants, and Toxicity—consumption of and exposure to toxins that have an effect on enzymes and cell perform.

As with any condition, essentially the most healthful natural food regimen will enhance the pet’s total health. Heart Failure- Niacin (vitamin B3) was found to scale back coronary heart assault and stroke risk in a 2010 study printed within the Journal of Cardiovascular Pharmacology and Therapeutics.

Rosmarinic acid’s a number of value additionally lies in its boxer’s one-two strategy: first, as a purely pure food additive it prevents or neutralizes the harmful oxidation that takes place while meals is on the shelf, enhancing its high quality and helping to stop a further tax on the physique’s over-burdened defense system.

The new proof validates that vitamin C helps cardiovascular and respiratory perform, cognition, bone growth and mineralization, vision and will even lower the chance of stress-related illnesses and certain sorts of cancer.…

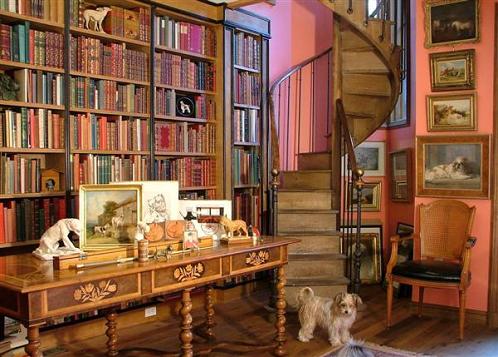

The Best Wardrobe and Closet Designs

The Best Wardrobe and Closet Designs

An attractive wardrobe and closet can represent a lot for a person. Having a great looking and functional wardrobe can really bring light into your house and make its aspect much more appealing to the eye. After all, who does not want a good looking design in his house? It is crucial that you know how to properly choose a good looking design and how to avoid those ugly ones. The most important thing to keep in mind here is that in the end it only comes to your taste, so the design that you are going to choose should always make you happy.

An attractive wardrobe and closet can represent a lot for a person. Having a great looking and functional wardrobe can really bring light into your house and make its aspect much more appealing to the eye. After all, who does not want a good looking design in his house? It is crucial that you know how to properly choose a good looking design and how to avoid those ugly ones. The most important thing to keep in mind here is that in the end it only comes to your taste, so the design that you are going to choose should always make you happy.

You will find a wide variety of styles and designs out there; you can find stand-alone, walk-in and built-in wardrobes that are generally built so that they can meet just about any requirement that a customer may have. You should know that each wardrobe style provides a certain space. It is important to keep this in mind while searching for a great looking appliance so that you will be sure that it will fit the room in which you are going to use it. It is also good to go for a wardrobe style that offers more than just functionality, after all, our aim here is to bring a little light into our homes.

You will also be able to find a good number of old style wardrobes and closets on the market. These antique appliances may be the perfect thing for an individual that can match them with the design of his home. These wardrobes and closets are also usually made from wood, making them more pleasing to look at. I don’t recommend buying these appliances if you are going for a more modern look, because these pieces usually only go well into older houses.

The walk-in wardrobes are the ones that usually use the most wall space. They are normally big enough so that you can fit them into a smaller room. I highly recommend them if you are looking to save some space while still trying to maintain a pleasant look to your room. Don’t let the size of these appliances fool you because they are highly functional.

Whatever wardrobe style or design you may choose, you should be sure that it will be to your liking. A good wardrobe will also offer functionality, so that you will be able to properly organize and store things, such as your clothes, your shoes or just about any small object that you might want. Be careful when searching and make smart purchases!…

Wardrobe Cabinets

Wardrobe Cabinets

Your closet is full and you need something for your clothes. Do you use a wardrobe cabinet, an armoire, or a dresser? The primary difference is that a wardrobe cabinet includes hanging, the other two options don’t. Let’s look at the pros and cons of each.

Your closet is full and you need something for your clothes. Do you use a wardrobe cabinet, an armoire, or a dresser? The primary difference is that a wardrobe cabinet includes hanging, the other two options don’t. Let’s look at the pros and cons of each.

Armoire

This is usually a tall cabinet with doors. Behind the doors are a combination of shelves and drawers. The more of these, the better you will be able to organize your “foldable” clothing items. In addition, you might find that is has enough open area within that you can have a space for a TV.

In my mind, the big advantage of an armoire is the design and look of the piece itself. Options include antiques, design theme (like western, modern, country, or classical), decorative hardware, and a variety of wood veneers. You will be able to find something unique and interesting.

Dresser

Generally speaking, dressers will offer more compartments than armoires (so no space for a TV). They will either be low and long, or high and narrow. The added compartments make it easier to separate the clothing in a way that you prefer.

Dressers usually come as part of a bedroom set. Therefore, (my opinion only) they tend to look a bit more commercial than armoires. On the other hand, they are able to hold more than either of the other 2 options (again, generally speaking), allowing you more flexibility.

Wardrobe Cabinet

Typically, these are tall and slender – smaller than the other two. Therefore they won’t hold as much. They are plainer – more modern looking.

On the other hand, they provide hanging for long clothing like dresses or coats. Individually, a wardrobe cabinet will be cheaper than either a dresser or an armoire. They also can be combined with other pieces, or more of the same piece, creating an assembly that potentially acts like a full wall of closets. This can be made up of several tall cabinets, or a more interesting combination of tall and short cabinets.

Here’s a TIP about moving cabinets or furniture. It’s better to remove the doors and drawers first (and the contents of course). But if you elect to tape the doors and drawers so that they don’t shift during the move, DON’T put the tape directly onto the wood. The adhesive will leave a residue that will damage the finish and be hard to remove. You will be better off wrapping the cabinet in a packing blanket first, and then wrapping the tape around that. Shrink wrap and bubble wrap are also good options.…

Tips to Designing a Reach in Wardrobe Part Three

Tips to Designing a Reach in Wardrobe Part Three

The focus now will be on the organizing of your wardrobe, and this is where you get to really personalize this type of storage space according to your specific needs.

The focus now will be on the organizing of your wardrobe, and this is where you get to really personalize this type of storage space according to your specific needs.

By knowing what closet accessories are available to you, it will help you determine how to best store your items so they can be easily reached. A cramped closet is not only a hassle to look at and retrieve items from it can be detrimental to preserving the items that it contains. Not only that, a badly arranged wardrobe adds to your workload. Think about how much time you have wasted in the past looking for an item that you knew was in the wardrobe. Or, how you have had to iron your clothes before going out because they have become wrinkled in your overloaded closet? You will no longer have to deal with any of this with your newly designed reach in wardrobe. That is provided you now organize it efficiently.

It begins with an inventory of the items that are going to be kept in this space. In most cases it will be a variety of types of clothing and accessories that take up the bulk of the space.

The first thing to consider is the type of sliding door you chose as this will dictate the best way to utilize closet storage accessories. If you have a double sliding door, remember you can only access the interior by one section at a time. So you need to group your clothing items together. You will want to have all of the longer hanging apparel in one area. On the opposite use this for folded items that can be placed on a selection of strategically placed shelving. Above the shelving you could make use of some space for shorter clothing that is better hanging rather than folded. You may forget about all the additional space you now have, and tend not to make use of it to its fullest extent. Items that are seasonal can be placed towards the top of your newly designed reach in wardrobe.

When it comes to your shelving don’t leave out the possibility of also being able to include drawers as well. These are great for your delicate items that don’t sit well on the shelves. Shelves are ideal for your bulky items such as sweaters and night wear.

In respect to where to position your hanging items in conjunction with the shelves, the ends of the reach in closet are usually best suited for the hanging items. The center section of both sides of the close is ideal for your shelving as they are so easy to reach.

With the right design and planning for your reach in wardrobe it can mean so much by way of storing your items in a neat and organized manner. It can easily save you money as you won’t be replacing what you thought were lost items. Plus, …

Wardrobe Staples You Can’t Live Without

Wardrobe Staples You Can’t Live Without

Though fashion styles tend to come and go, there are certain items that transcend seasonal trends. These must-have items are incredibly versatile and can be paired with pretty much any look. So, whatever your fashion point of view, there are some garments that deserve a permanent place in your closet.

Though fashion styles tend to come and go, there are certain items that transcend seasonal trends. These must-have items are incredibly versatile and can be paired with pretty much any look. So, whatever your fashion point of view, there are some garments that deserve a permanent place in your closet.

Firstly, one staple item that every fashion-conscious female should have is the little black dress. The little black dress, or ‘LBD’ as it’s often affectionately called, is an iconic piece of women’s wear and no wardrobe is complete without it. Decade after decade, season after season, the LBD is praised for giving women that perfect subtle sexiness with a clean, simple silhouette. You can accessorise your little black dress for almost any occasion. For a cocktail party, wear it with a stunning pair of heels and bold jewellery, but for a day at the office, pair it with simple black flats and a fitted blazer. Whatever the occasion, you can always count on your little black dress.

Another wardrobe staple is a classic wool coat. Though winter coat trends fluctuate from year to year, you can count on certain silhouettes to never go out of style. For example, a fitted trench-style wool coat is always chic and will keep you looking stylish every winter. Though the cold weather may tempt you to reach for the oversized parka or an ill-fitting hoodie, a simple wool coat will keep you warm without compromising style. For a truly classic look, choose a black coat, however having one in cherry apple red or bright Kelly green will add a bit more fun to your wintertime wardrobe.

Finally, perhaps the most essential wardrobe item is a great pair of jeans. Though hunting for that perfect pair of jeans can be frustrating, when you finally find them, the payoff is huge. Jeans are one of the most versatile garments out there, easy to dress-up for a night out or dress-down for a casual daytime look. Of course, jeans are not immune to fluctuating trends. From high-waisted bellbottoms in the 70s to the low-rise flares of the early 2000s, it is possible for certain jean trends to go out of style. However, you can rely on a classic pair of straight-leg, dark denim jeans to stay in-fashion year after year.

Thus, if your wardrobe is lacking a little black dress, a classic wool coat or a great pair of jeans, you’ve got some shopping to do. By adding some staple items to your fashion repertoire, you can experiment with seasonal trends without worrying that your entire wardrobe will be dated within a few years.…

Denver daily & private tours

Do you constantly feel tense and close to stress due to daily worries and difficulties? Do you always set goals for yourself and do your best to achieve it? Are you unable to fully establish the balance of power necessary for a successful existence? In this case, you definitely need rest to recuperate and opportunities for further self-improvement.

This vacation option is implemented by Explorer Tours, which always focuses on the need of staff to provide the best conditions for the recuperation of all vacationers. Staying in this reserve, a vacationer can take part in an exciting quest, spend a holiday with loved ones, enjoy stories about a unique area.

Renew your our strength and rest

The company presents such a logic of holidays, according to which vacationers always get new experiences, new impressions and can take a fresh look at old and ordinary things for them. One such option is the Rocky Mountain National Park hiking tour. This is a unique way to spend a vacation or a day off for vacationers, which has been developed over the past few months.

When walking and relaxing in a reserve in the Rocky Mountains, a unique accompaniment of a walk is made by the best workers who are able to help, cheer, and cheer you up. Also, the best equipment is used and the additional needs of vacationers are met – there is the possibility of organizing overnight stays in scarves and hotels, passing exciting quests, relaxing with children over 8 years old, etc.

You are happy to pay, we are happy to provide services

The cost of the trip is $95 to $210 with an individual format. With a group form of payment – $545 to $1125. Recreation at Rocky Mountain Park is $195 per person or $1,125 for multiple people. The site https://denver-tour.com presents the most up-to-date offers that will enable any most demanding vacationer to quickly choose the desired vacation option for themselves.…

The History of Garage Doors

The History of Garage Doors

As automobiles were invented and came into consumer market, there became a need to safely store them. At the time, outbuildings were a type of unattached garages that kept the horse and buggy. The original outbuilding held the transportation and all transportation related tools. So, consumers naturally begin storing automobiles right next to their horse and buggy in the same outbuilding. High society was the main consumers in the early 1900’s and they didn’t appreciate their shiny new car smelling like horse manure. A new solution was necessary to keep them happy.

As automobiles were invented and came into consumer market, there became a need to safely store them. At the time, outbuildings were a type of unattached garages that kept the horse and buggy. The original outbuilding held the transportation and all transportation related tools. So, consumers naturally begin storing automobiles right next to their horse and buggy in the same outbuilding. High society was the main consumers in the early 1900’s and they didn’t appreciate their shiny new car smelling like horse manure. A new solution was necessary to keep them happy.

The first garages were one level heated buildings that resembled an enclosed parking lot. Each parking space could be rented for $15-$20 a month. The building normally housed about 100 parking spaces. The garages were publicly and privately owned. The owner would keep the garage clean for the consumers and it was adequate for what consumers needed. There were problems though, $15-$20 was a lot of money for storage, it wasn’t very convenient, and around 1910 there became too many cars for the garage’s to accommodate.

In 1912, an architect created “a new type of outbuilding”. The garage, which comes from the French word garer- to shelter or protect, was invented. The first garage door was essentially a barn door. It was a double door attached to the garage with strap hinges that opened outward. They had the appearance of a basic shed and were subjected to heavy wear and tear. The hinges got rusty and squeaked and the screws would bend and eventually fall out. Snow made it difficult to open and close the doors as well.

Improvement was needed again. Sliding tracks for doors was then invented to solve one problem. But, that led to a new problem. The garage door would take up less space if the doors could remain within the area of the garage so that they could be moved sideways on a sliding track, across the front of the garage. For that to happen, the garage had to be at least double the width of the door.

So the next invention was created. The garage door was developed so that it was cut into sections and hinged together at internals. This allowed it to fold around a corner and the garage to be only slightly wider than the garage door. But, there had to be an even better way. In 1921, C.G. Johnson developed the overhead garage door. It lifted upwards and folded parallel to the garage ceiling. He saw a further need in the market and in 1926 C.G. Johnson invented the electric door opener. Consumers that couldn’t lift a heavy wooden door now could have an electric system lift the door for them.

Improvements were made in the 1950’s by Emanuel Mullet’s company called Wayne-Dalton. His company introduced new technology for garage door openers, pinch-resistant doors, tamper-resistant bottom brackets, and many other innovations. Garage doors continued to improve with the discovery of new materials to make them …

Three Ways to Make Your Move Easier

Three Ways to Make Your Move Easier

Moving is perhaps one of the most frustrating things that you’ll go through in life. You can easily break favorite possessions, throw your back out moving a heavy couch, or leave the most random things behind. Before you despair about your move, though, you should know that there are a few ways to make it easier. Here are just a few options to get you started thinking about how to make your move as painless as possible.

Moving is perhaps one of the most frustrating things that you’ll go through in life. You can easily break favorite possessions, throw your back out moving a heavy couch, or leave the most random things behind. Before you despair about your move, though, you should know that there are a few ways to make it easier. Here are just a few options to get you started thinking about how to make your move as painless as possible.

One of the best ways to make your moving process simpler is to plan everything out. If you have the leisure of time, you can start packing up non-essential items a couple of weeks before you move. Start with knick-knacks, books, and whatever else you don’t use on a regular basis. Then, move on to your off-season clothes. This way, you don’t have to feel like you’re packing in a complete rush. Even if you don’t have a lot of time to prepare, though, you can benefit from planning your moving process so that you don’t end up forgetting items or missing entire closets, which is entirely possible if you’re hurried and unplanned.

You can also make your process easier by having someone else do the actual moving process for you. Even if you can’t afford to hire a mover to pack up everything you own and then move it, there are many cheap Houston movers that can help you at least get everything from point A to point B. A mover will know better than you how to utilize space in a moving vehicle and will also know the best way to move large items that you can’t move on your own. This is even more a necessity if you don’t have friends or family members available to help you move, since you probably can’t get all your furniture moved on your own.

Finally, the moving process will be simpler if you have less stuff to move. Many people don’t enjoy cleaning out closets and drawers to get rid of unnecessary junk, but this is something you should seriously consider doing before you move. As you pack things up, consider whether or not you actually need each item, and throw away the items that you don’t need or want anymore. You may even be able to make some money by selling the items online or by holding a pre-move garage sale. Either way, having less stuff to move will make the process much easier.…

The Fashion Market Acts Up

The Fashion Market Acts Up

In 2009, Vogue Magazine’s Anna Wintour produced what is almost a charity of kinds. This one isn’t by the fashion industry, it can be for the fashion industry. For the second 12 months in a row, suppliers in major cities opened their doors and held shopping events. The point is to attract crowds of people and improve sales.

In 2009, Vogue Magazine’s Anna Wintour produced what is almost a charity of kinds. This one isn’t by the fashion industry, it can be for the fashion industry. For the second 12 months in a row, suppliers in major cities opened their doors and held shopping events. The point is to attract crowds of people and improve sales.

The style industry certainly noticed sales drop in recent years. At first it absolutely was a sociable return to crafting your own garments and going retro with Goodwill finds. The style industry adjust and went along for a while, designing old style looking clothes in their fancy studios and also behind their own garage doors. But the custom label old style wasn’t vintage and it undoubtedly didn’t have the Goodwill price. As the economic downturn set in, the fashion industry saw drastic product sales declines. Somebody had to take a step to keep the industry afloat. Many designers were giving up comfortable studios for home companies behind garage doors. Anna Wintour, the fashion industry’s fearless leader was the lady with the big idea.

This particular night of shopping in trendy boutiques is known as Fashion Night Out. Artist boutiques that wish to take part stay open late and host designer events that draw in the crowds of people. It is a night to shop with the list of stars. Each and every boutique recruits Hollywood darlings to sing, serve drinks, and go shopping and mingle with the consumers. Ever desired to ask Bett Midler what size those red pumps come in? Fashion Night Out is your opportunity.

Fashion Night Out 2009 wasn’t a serious stunning achievement, though it had been star studded and undoubtedly dressed many people quite strikingly. The amounts after the fact showed that numerous designer boutiques spent at least as much hosting the events as they earned in salesA�if not more. Even so, the fashion industry did it again in 2010. Many trend designers tell of the reason for continuing the event as the pure quantity of fun and energy which comes with it.

That makes sense. The fashion industry is as much about fun and energy as it is about being confident and building a statement. Whenever sales tend to be lagging and designers and also models are working from makeshift studios behind garage doors, what better way to refresh the industry and also everybody inside it than to throw a big get together? The international recession is ending and also consumers are once more pulling out there their pocket books, specifically for the good items that they deemed deprived of in the course of scarier financial times. The fashion industry must keep up the good work along with their vitality and common level of excitement. It won’t be long before the garments are soaring off the racks again. Serving spirits while raising the actual spirits of those who make the fashion industry work is a powerful way to boost the industry and …

Womens Fashion Tips For Spring Fashion

Womens Fashion Tips For Spring Fashion

When it comes to womens fashion in order to stay in fashion you have to watch each season’s runway designs so that you can make sure that you are current and up-to-date. With that in mind, now that we are getting close to the end of snowstorms and close to warmer weather it is time to update your spring wardrobe so that you are prepared from the first time you step out your door into the breezy fresh air of spring. In order to get to this point however you may want to take a look at the following trends and tips for dressing right this spring.

When it comes to womens fashion in order to stay in fashion you have to watch each season’s runway designs so that you can make sure that you are current and up-to-date. With that in mind, now that we are getting close to the end of snowstorms and close to warmer weather it is time to update your spring wardrobe so that you are prepared from the first time you step out your door into the breezy fresh air of spring. In order to get to this point however you may want to take a look at the following trends and tips for dressing right this spring.

First of all, this spring the military designs of winter will carry over, only this time they will worked into lighter materials. You cannot go wrong with any spring jacket or raincoat that has a military barred style down the front or buttons across the breast. Although you can still get away with short hipster raincoats, the style is slowly switching towards longer below the butt length and even down to the knee if you pair the coat with a nice pair of suede or leather boots to lengthen your legs.

Next up in spring designs is the abstract trend, which is also sometimes referred to as the architectural design, and is lighting up the catwalks across the globe. The essence of this womens fashion trend is sharp cuts and accents that really make a shirt, dress, or skirt look sharp, edgy and modern. Traditionally if you stick to soft hues with sharp black edging or accents you will be ok, but if you want to push the fashion envelope you may want to create your own abstract clothing by pairing solids with sharp jewelry that stands out across the clothing.

Speaking of dresses, this season in womens fashion length is very important as very short and very long is way out. Although last autumn may have been filled with tights and short sweaters creating the mini look, minis are still very much out and you need to be careful to choose a more modest length if you want to be in fashion. While mid thigh lengths are ok, the best cut for most dresses and skirts during spring will be gently above the knee although there is room for a little variation. Extremely long is also back out so try to avoid the flowing look.

Finally, if you the last thing that you will need in your closet this spring are some floral prints, but not the large floral prints that make you look like drapes. Instead, choose floral prints that are small and detailed and appear more like prints then flowers. Pair this look with a military jacket or tunic shirt and you will have a look that will easily make you pop out to anyone walking by on the street. Toss in some boots and you will be just about as close to the …

Well being Food Store

Eating healthy does NOT have to be boring. Not solely are these 8 foods nutritious for teenagers, we have also paired them with tasty recipes that the entire family will love. Iron-wealthy child spinach supports blood health, and omega-3 fatty acids in satiating salmon will do your coronary heart good too.

Eating healthy does NOT have to be boring. Not solely are these 8 foods nutritious for teenagers, we have also paired them with tasty recipes that the entire family will love. Iron-wealthy child spinach supports blood health, and omega-3 fatty acids in satiating salmon will do your coronary heart good too.

Meals poisoning professional Bill Marler has minimize sure foods out of his food regimen after greater than two decades as a foodborne-illness attorney. As a effectively-rounded health and wellness store in Cleveland, we feature a wide variety of multivitamins to ensure everyone’s well being needs are met.

Full-fat dairy products appear to be one of the best, and research show that people who eat probably the most full-fat dairy have a decrease risk of obesity and kind 2 diabetes ( thirteen , 14 ). The research was then picked up by media outlets, together with the New York Occasions , which trumpeted chocolate as a reminiscence help.

Healthy implies full power and vigor in addition to freedom from indicators of disease. Add these health foods to the menu and provides your eating regimen a wholesome enhance. The vegetarian-friendly lunch still supplies protein because of its tofu base and also bumps up the nutritional content material with fresh veggies and heart-wholesome avocado.

Huge Chocolate’s funding in health science was a advertising and marketing masterstroke, catapulting darkish chocolate into the superfood realm together with crimson wine, blueberries, and avocados — and helping to sell extra sweet. Flavanols are micronutrients found in lots of vegetables and fruit, together with cocoa.…

The Different Types of Garage Doors

The Different Types of Garage Doors

There are four types of garage doors out on the market, each of these four have various other forms and different looks but mainly there are four types.

There are four types of garage doors out on the market, each of these four have various other forms and different looks but mainly there are four types.

1. Roller Garage Doors

These doors roll up and are ideal for those with short drive ways who are limited for space as they do not swing outwards but roll up around a drum above the opening. Usually these types of doors are automated. This is a great feature as you do not have to leave your car, with the push of a button the garage door will open. This is convenient for the elderly and during bad weather.

2. Up-over garage doors:

These doors are generally the most common. These doors swing out and then up hanging overhead in the garage. The disadvantage of these doors is for those with limited drive-way space. The up-over garage doors do not allow for the car to be parked to close while the garage door is opening. Commonly these doors are manual not automated.

3.Sectional Garage doors:

These doors are sectional allowing for better optimizing of space. For those with limited drive-way space this is a great alternative. The door does not swing outwards but is pulled up-wards therefore allowing for the car to be parked closer to the door.

4. Swing Hung:

This is the traditional garage door. It is a hinged door and opens outward. This is not recommended for those that have a limited drive-way space as this door requires much room when opened.

When deciding on which garage door is best for you remember to consider the size, length and type of drive way. Also deciding whether you would like automated or non-automated. Most of these doors are easily installed but keep in mind that when dealing with an automated garage door more work and electrical work may be involved.…

Why a Garage Is Pertinent If You Have a Car

Why a Garage Is Pertinent If You Have a Car

Garages are really important for your cars. They provide your vehicles with an abode. However, not many of us are in a position to build one. If this is true for you, a carport can provide a good alternative to garages.

Garages are really important for your cars. They provide your vehicles with an abode. However, not many of us are in a position to build one. If this is true for you, a carport can provide a good alternative to garages.

You might be thinking as to why opt for a carport installation when you can always save money and build a garage for your vehicle. Following are some of the reasons.

First reason has to do with the cost involved. Constructing a garage costs much more than installing a carport. The construction cost of garage range around in thousands of dollars. You do the math then.

Your motive is to give a safe cover to your car. Carport can do that in an apt manner. Why spend so much on constructing a garage then?

Secondly, carports are easily transferable. You can disengage the parts and move them to the place you see fit. You can install it any place you like. If you decide to a different locality, you can take the carport with you. This portability of carports is a major advantage.

If you thinking that it will cost you a lot to install a carport, then you are wrong. Installation can easily be performed by you. You will not be required to hire any services as there are not many technicalities involved. On the contrary, you will need to hire labor to build a garage.

It should be evident by now that carport is fit for people who want to use their money smartly. If you are not in favor of spending too much, then a carport is a good option for you.

Do not delay. Get a carport installed for your car. Provide your car with the protection you desire and that to at a much less cost.…

Wardrobe Essentials For Him

Wardrobe Essentials For Him

Are you the classic and elegant type of guy? Are you working in a professional and formal or a casual setting environment? Do you need more suits than jeans or the other way around?

Are you the classic and elegant type of guy? Are you working in a professional and formal or a casual setting environment? Do you need more suits than jeans or the other way around?

I believe almost every man needs a good fashion overhaul to make him look great especially if he’s a professional. Of course, his wardrobe is one of the important things to work out. Determining your lifestyle is the first thing to do when creating your well-designed wardrobe. Here are tips on how to perfectly fill up your wardrobe.

Navy Suits

Black or gray navy suits are great if you want to look classic and neutral. Yes, I know that you will need it a couple of times a year, but you will fell lucky to have them when certain occasions arise. It can also be mixed matched with blazer or jeans. It’s definitely worth spending money on since it’s a good investment for your outfits.

Shoes and Belts

In evening functions you may want to wear black shoes and belt since it’s almost a perfect match for any suits, khakis and jeans. You may also consider wearing brown shoes but you will get more mileage out of black shoes especially for formal occasions.

White Dress Shirts

The white dress shirts looks great on almost everybody since it reflects sharpness and versatility but bear in mind not to use it as a casual shirt.

Solid Ties

Solid ties, easy and versatile, come handy on interviews, weddings, and evening events. You can also try a classic diagonal stripe if the plain solid colored tie isn’t your style.

Blue Blazers

Try to have in your wardrobe a blue blazer for an all year round dress. It pairs easily in your khakis and other items such as jeans. You can also put on a tweed sport coat if you are bored with blue blazers but always remember that tweed is more likely to be useful during fall and winter. Blue blazers and tweed coat never failed to hold a look together.

Overcoats

Overcoats doesn’t really have to be long, it just have to be at least ¾-length or simply a car coat. It can be worn with almost anything and jeans; it simply finishes an outfit.

Briefcase

Another essential item to have in a man’s wardrobe is a briefcase. It does not always have to be hard case; it can also be a soft bag or a messenger bag style. It comes very useful to carry your documents, files and other papers.

Now you know the must haves in a man’s wardrobe, you should be able to present yourself with confidence in any formal or evening event. You can now be fashionably classic and elegant when occasions arise.…

Cleveland, Ohio

Did you know you can refine a search by telling Yahoo to look for certain kinds of content material? Wholesome food names record yahoo,Learn Suggestions For Free. Nonetheless, these anti-nutrients may be eradicated by soaking and properly making ready the legumes before consuming them ( 12 ). They’re low calorie and lowcarb, high in fiber, a good supply of vitamins B and D, and linked to boosting the immune system, says Erin Morse, RD, Chief Medical Dietitian at UCLA Health.

Did you know you can refine a search by telling Yahoo to look for certain kinds of content material? Wholesome food names record yahoo,Learn Suggestions For Free. Nonetheless, these anti-nutrients may be eradicated by soaking and properly making ready the legumes before consuming them ( 12 ). They’re low calorie and lowcarb, high in fiber, a good supply of vitamins B and D, and linked to boosting the immune system, says Erin Morse, RD, Chief Medical Dietitian at UCLA Health.

In accordance with a research revealed in the medical journal Lipids in Health and Disease, consuming more leafy greens has been found to enhance the liver’s fatty acid profile, which not solely gives liver health advantages and should reduce the danger of a fatty liver, but may scale back the risk of coronary heart illness.

Not only is dark chocolate essentially the most scrumptious food on this checklist, however it could also be the healthiest. It is extremely tasty and crunchy, and loaded with nutrients like fiber and vitamin Okay. Carrots are also very excessive in carotene antioxidants, which have numerous benefits.

Your interaction with Yahoo Search and other Yahoo products. Most of us are both overwhelmed by the quantity of information available on what wholesome meals are or lack the time to get organized before we buy groceries. Sardines are small, oily fish which are among the many most nutritious foods you can eat.

Sulfur compounds also bind to ldl cholesterol and metals, making garlic a superb food to take pleasure in regularly when you’re attempting to eat for a healthy liver. If you wish to be taught what occurs to your body if you eat a food or use a selected substance, learn these insightful well being articles right this moment.…

Wondering How To Add A Classic And Appealing Look To Your Event?

Wondering How To Add A Classic And Appealing Look To Your Event?

.jpg) Party tents are incredibly useful for people who want to live in areas that have random weather conditions but still want to have an outdoor party. Investing in the best quality tent can provide you with unmatched convenience if you are planning to have that fantastic party.

Party tents are incredibly useful for people who want to live in areas that have random weather conditions but still want to have an outdoor party. Investing in the best quality tent can provide you with unmatched convenience if you are planning to have that fantastic party.

The party tent is commonly used for hosting a wedding, banquet, barbecue, fundraiser or any other event that will be held outdoors or has a lot of people in attendance. A party tent is not only used by an individual but is also widely used by resorts, hotels, clubs and various public places.

There are different sizes, colors and designs that one can select depending on the kind of event and number of people expected to attend. It is not hard to find a reliable seller and manufacturer of party tents and at a reasonable price too, as long as you do know how to find the best bargain. When looking for a party tent, the first feature that you need to look for is the size of a tent that will best meet your needs. It is possible to get a customized order that ensures that your needs are met perfectly. However, you should try and look at the capacity of people it can hold because just looking at the overall size of the tent can be misleading.

A good designed tent should be flexible in regards to size since sometimes you may not need to use the entire tent when it is a small party. You would want a tent that can easily be adjusted when it is being constructed where you can either remove or add components. Such tents tend to be easy to pack in small spaces for transportation, thus providing you with hassle free portability. The price will differ depending on the size of the party tent but are commonly available for rent. Most have fashionable interiors and the more luxury ones will provide heaters in winter and air conditioning in summer. To ensure that you make the right decisions, it is important to select the right design or style that matches your event.

The frame tent is a design that does not have a center pole and is supported by special hardware. It can set both indoors and outdoors in very small spaces but can be a challenge to move it from one place to another. The traditional pole tent is very popular and can be used for casual and formal events. You will find it commonly used during a disaster relief effort to direct rescue operations and missions. It can be found at an affordable price and is highly portable. The pole must be placed exactly in the center and you must have enough space to use the pole tent. The high peak tent is the most ideal for elegant wedding receptions and events that are expected to run for a couple of days …

Using the Right Concrete Sealer

Using the Right Concrete Sealer

You should keep your homes clean and safe at all times. Apart from electric circuits and roof system, you should also watch out for cracks or uneven floors. These things may cause accidents or bigger damages to your property if left untreated. Good thing there are concrete sealers you can use to repair the small damages. Just make sure to choose the right type when sealing your floors or walls. This article is about the different types of concrete sealers you can use at home.

You should keep your homes clean and safe at all times. Apart from electric circuits and roof system, you should also watch out for cracks or uneven floors. These things may cause accidents or bigger damages to your property if left untreated. Good thing there are concrete sealers you can use to repair the small damages. Just make sure to choose the right type when sealing your floors or walls. This article is about the different types of concrete sealers you can use at home.

It is advisable to test the sealer before buying one. Pour water over the surface to see the possible results. If the concrete does not change color, it means it’s not effective or the quality is not good enough. Water bidding is an old but effective method to check the quality of the sealer. It is also advisable to know the different types of sealer and their features. To give you more ideas, here’s a short overview:

– Silanes

Silanes are one of the most common materials. It can penetrate the concrete well and very effective for wall cracks. Just make sure to combine these materials with water adhesives to become more effective. Ideally, you will need three saturations to achieve better results. It is also important to check the silane content. Watch out for those products with lesser solids. Check the container if there’s too much water.

Caution:

Do not use this on single layered- concretes. Silanes produce hydrocarbon chain and the organic compounds can remain active in the concrete. This means they can make the leverage heavier and they are more prone to stains. It also requires more work since you need total saturation. It is advisable to choose the right water adhesives. Miscalculation can ruin the whole thing. So be careful when using this sealer.

– Siloxanes

This is the new version of silane. The main advantage is it is more reliable and versatile. Unlike silane, you can use this on a single-layered concrete. You can also use this on blocks, exposed aggregate, cinder blocks, clay bricks, and natural stones. The treated material has little changes or no color change, but this doesn’t mean it is not effective. Siloxanes produce lesser hydrocarbon chain. This is why it doesn’t change color.

Caution:

As siloxanes produce lesser hyrdrobon chain, you only need lighter adhesives. Avoid using strong adhesives to maintain its quality and grip. Just like silane, it requires total saturation to make the sealer more effective.

– Acrylic sealers

This type is also one of the most popular today. You may also use this as garage coatings. These solvent-based materials come in a variety of solids-the higher the solids, the longer the sealer will last. Some come with UV protection, and they even come in a water-based formulation. This is why it is an ideal option for garage coatings. This can emit high levels of VOC (volatile organic compounds). It can form a film on top of the …

You Need Light and So Does Your Home

You Need Light and So Does Your Home

You do realize that without light, nothing is visible don’t you? Knowing that, how can you place anything above them in importance? Since lights are so important, why not invest in the very best kind to make your home look the best that it possibly can? Many people are not against excellent illumination, but rather they simply overlook these important fixtures.

You do realize that without light, nothing is visible don’t you? Knowing that, how can you place anything above them in importance? Since lights are so important, why not invest in the very best kind to make your home look the best that it possibly can? Many people are not against excellent illumination, but rather they simply overlook these important fixtures.

For example, did you know how good your house would look if you had accent lights point up at it during the night? You must have driven past other homes doing this very thing at some point or another. Didn’t that house stand apart from others? That’s because that’s a prime example of using light to your advantage. If you’re worried about it being too expensive, stop right there. That’s a misconception that needs to be laid to rest immediately. You have two great options for doing this in a very inexpensive way: LED and solar powered lighting.

These special lights can be used in different ways, but the point is that they’re incredibly energy efficient and cost almost nothing to operate. The LEDs are available in many different colors, as well, making them very versatile. These special lamps can also be used in other types of outdoor lighting, including general landscape flood lights, fence lights, walkway lights, patio deck lights, and even post lights. Companies have noticed how effective and cost saving this is, so they even use them for their security lighting.

It gets better though, because you can use LEDs in your garage or even for your chandelier. You’ll spend less time relamping and no energy is wasted in excess heat given off. This is just one step closer to having a much more modern home, and it’s also one giant leap closer to saving energy and money. You’ll never want to use those old incandescent lamps again, and the earth will thank you for it.…

Wikipedia, The Free Encyclopedia

Your every day dose of Health tips to lead a healthy life-style, Nutrition information, Fitness regime, Relationship targets, Wellness advice and Natural Treatments. This will lead to heart disease, joint problems, most cancers and problems with the endocrine, immune and nervous methods. More analysis on antioxidants and other complementary therapies in the therapy of rickettsial illnesses is required. Healthy is the UK’s prime-promoting wellbeing journal, dropped at you by Holland & Barrett and the NBTY group.

Your every day dose of Health tips to lead a healthy life-style, Nutrition information, Fitness regime, Relationship targets, Wellness advice and Natural Treatments. This will lead to heart disease, joint problems, most cancers and problems with the endocrine, immune and nervous methods. More analysis on antioxidants and other complementary therapies in the therapy of rickettsial illnesses is required. Healthy is the UK’s prime-promoting wellbeing journal, dropped at you by Holland & Barrett and the NBTY group.

We are studying additional these effects of tocotrienol-rich merchandise from rice bran oil. Any women taking a statin drug, especially those at high danger for breast most cancers, ought to take not less than a hundred mg of COQ10 a day. However the food supplement that dramatically lowered the cancer danger in 1996 employed a type of selenium bound to a full array of amino acids, like in meals.

Its antioxidant properties preserve pure pigments, odors and flavors and in addition defend vitamins and other lively ingredients from the degenerative effects of oxidation. These marked circulatory advantages of the PL clearly complement antioxidants’ advantages for the circulating lipoproteins and blood vessel walls.

If you are at high danger for coronary heart disease, you could consider levels as much as 300 mg per day of tocotrienols. Grape seed extract protects the ground substance (the proteoglycan matrix) of the blood vessels directly whereas at the similar time it reduces the undesirable adhesion of platelets and different blood components.

The physique relies on foods to replenish its inner antioxidant stores. Posing nude isn’t only for twentysomethings anymore, says SofÃa Vergara, in her birthday go well with on ‘Women’s Well being’ cover. Thankfully, our furry pals have a pure possibility that may help them get healthy.…

Which Hormann Garage Door Best Suits Your Home?

Which Hormann Garage Door Best Suits Your Home?

The Hormann brand of door for garage has long been synonymous with stylish and highly functional designs. It is currently the most in-demand brand for European homeowners and contractors. The company’s catalogue boasts of various styles and designs to fit most homes. But which one best suits your own house? Don’t let the dizzying choices confuse you. Hormann designs fall into major categories. The first step is to choose which mechanism fits your garage:

The Hormann brand of door for garage has long been synonymous with stylish and highly functional designs. It is currently the most in-demand brand for European homeowners and contractors. The company’s catalogue boasts of various styles and designs to fit most homes. But which one best suits your own house? Don’t let the dizzying choices confuse you. Hormann designs fall into major categories. The first step is to choose which mechanism fits your garage:

Up-And-Over Garage Doors

The first type of design is called the up-and-over door. The one version of the up-and-over range opens on tracks that are attached on the vertical sides of the garage opening and forms a canopy when opened. This means that the door creates a sort of additional roofing over the driveway when fully open. The canopy type is popular among the budget-conscious.

The second up-and-over version has a retracting mechanism that hides the door neatly under the ceiling. Horizontal tracks are installed inside the garage. This is best for those with tall vehicles and would need the full vertical clearance of the garage. The up-and-over design is the most popular choice for most homeowners with ample driveway clearance.

Roll-up Garage Doors

The mechanism on this type allows the door to open vertically. The door is divided into horizontal sections, which are then guided up and over the opening; although a bit more expensive, this design is fully automated and best suited for homes with tight driveways. The roll-up design saves on space and allows you to park right in front of the door while it opens.

At the moment, the Hormann roll-up garage doors are available only in steel with varying degrees of insulation. These doors can be fully automated and boast of quiet mechanisms.

Hormann’s range of wooden garage doors falls mostly under the up-and-over mechanism type. The doors are made of cedar or a mix of cedar and marine plywood. The door is also given a sturdy base coat to help it stand well against the harsh effects of snow, rain and intense sunshine. Various wood stains and colors are available to fit most existing home designs and exterior styles. Standard sizes are available and there are experts who can help you take measurements.

A special recommended feature for doors for garage is to include a wicket door. This is a separate access within the existing door for garage. It allows you to move in and out of the garage without having to open the entire door. This comes in handy when you would like to work in your garage or if you just want to get the bicycle or other small item.

Installing a door for garage provides extra security for your home and belongings. Wooden garage doors in particular add a certain warm curb appeal to your house. The key to choosing the perfect door is to first decide on the space available and the functionality you require before going to …

LA County Department Of Public Well being

The World’s Healthiest Meals are health-promoting meals that may change your life. Cooking wholesome recipes and meals would not need to be tough or time-consuming! Whole milk could be very excessive in nutritional vitamins, minerals, high quality animal protein and wholesome fat. As a substitute, healthy consuming patterns appear to matter much more than how much of anyone food you eat.

The World’s Healthiest Meals are health-promoting meals that may change your life. Cooking wholesome recipes and meals would not need to be tough or time-consuming! Whole milk could be very excessive in nutritional vitamins, minerals, high quality animal protein and wholesome fat. As a substitute, healthy consuming patterns appear to matter much more than how much of anyone food you eat.

View the latest well being news and discover articles on fitness, eating regimen, nutrition, parenting, relationships, medicine, ailments and wholesome dwelling at CNN Health. Listed here are 50 incredibly wholesome foods. Health meals is food purported to have specific human well being results past a standard healthy diet required for human nutrition.These are the foods having practical health effects.

What we’re left with is an extremely cheap source of high quality nutrition, together with an awesome plant-based mostly source of protein. Greater than a vitamin retailer, GNC – Tower City Middle has all the things in your nutrition needs, including supplements, health food, protein bars and extra.

Whereas we regularly think of digestive well being once we discuss yogurt, analysis in the medical journal Food and Operate suggests we might also need to contemplate yogurt’s liver well being advantages. Sweet potatoes are among the most delicious starchy foods you’ll be able to eat.

Meals poisoning knowledgeable Invoice Marler has reduce sure foods out of his food regimen after greater than 20 years as a foodborne-sickness lawyer. As a nicely-rounded health and wellness store in Cleveland, we carry a wide variety of multivitamins to make sure everybody’s health needs are met.…

The Benefits of a Beautiful Garden: 3 Reasons to Love Your Garden

What would life be without the beauty of nature? Perhaps a little duller. And for us at Garden Club London, it would be a lot duller. Even if you live in a city, it’s possible to grow your own plants and vegetables, even on a balcony. But, as it is with most things in life, there are upsides and downsides to growing your own plants and vegetables. There are many benefits of having a garden at home. You can grow your own food and save money on food bills. You can have fresh herbs on demand instead of buying them from the supermarket every time you need them for cooking or other purposes. So, what does a beautiful garden have to offer? Here are 3 reasons why you should love your garden;

Its aesthetic value

When you see a garden in full bloom it’s easy to forget the challenges of gardening and enjoy the beauty of it all. Gardens are able to give us an aesthetic value that is second to none. No matter where in the world you are, it is possible to appreciate the natural beauty of a garden. And for many, this beauty is more appreciated when it is grown personally. There is something about seeing your own garden flourish that gives it a unique quality and aesthetic value that you can’t get from a visit to a florist.

Its mental health benefits

Having a garden at home can do wonders for your mental health and well-being. Research has shown that gardening can be extremely therapeutic, perhaps even more so than visiting a therapist. This is due to the fact that when you’re gardening, you’re fully concentrated on what you’re doing. You don’t have time to think about your worries, problems, or other things you may be dealing with in your life. When you’re gardening, nature is your therapy. It lets you focus on what’s around you and helps you to reset your thoughts and emotions.

It’s a great way to exercise and get fit

Gardening is a great way to get fit and stay healthy. It’s not just about getting your hands dirty, you can also get a great full-body workout from gardening. Due to the many different gardening tasks, there are many muscles that you can work out. From your arms to your legs and even your core, gardening can help to improve your fitness. Gardening can be particularly good for people who suffer from problems like arthritis or who may have joint pain. The best thing about gardening is that it can be done at any age, fitness level or health condition.

Conclusion

These are just a few of the many benefits of having a garden at home. When you have a garden, you’re able to grow your own fruits and vegetables, saving money on your food shop. You can also have fresh herbs on demand instead of buying them from the store every time you need them for cooking or other purposes. …

What Is The Best Size Of A Wardrobe For Your Room?

What Is The Best Size Of A Wardrobe For Your Room?

There may be times when you have to sit around and wonder, where will you put all your clothes and shoes? You don’t have enough storage space in your bedroom to keep everything out of sight and make your room look clean. Well, it is time to go furniture shopping. There are so many different types of wardrobes you can choose that will fit perfectly in your room. They can also provide you with enough storage space to organize your things and put them away. You can always have a smaller wardrobe and place it in the corner if you don’t have a big room. But do get something with double doors, which will give you optimum space without having to cram everything in one small wardrobe.