Investment Property Opportunities: A Guide

Investment property opportunities are abundant in today’s dynamic real estate market. Whether you’re a seasoned investor or new to the game, navigating the realm of investment properties requires insight, strategy, and a keen eye for opportunity. In this comprehensive guide, we’ll explore the various avenues available for investors looking to capitalize on the potential of real estate.

Understanding the Landscape

Before diving into investment property opportunities, it’s crucial to understand the landscape of the real estate market. This involves analyzing market trends, economic indicators, and local dynamics that can impact property values and investment potential. By gaining a holistic view of the market, investors can identify emerging opportunities and make informed decisions.

Research and Due Diligence

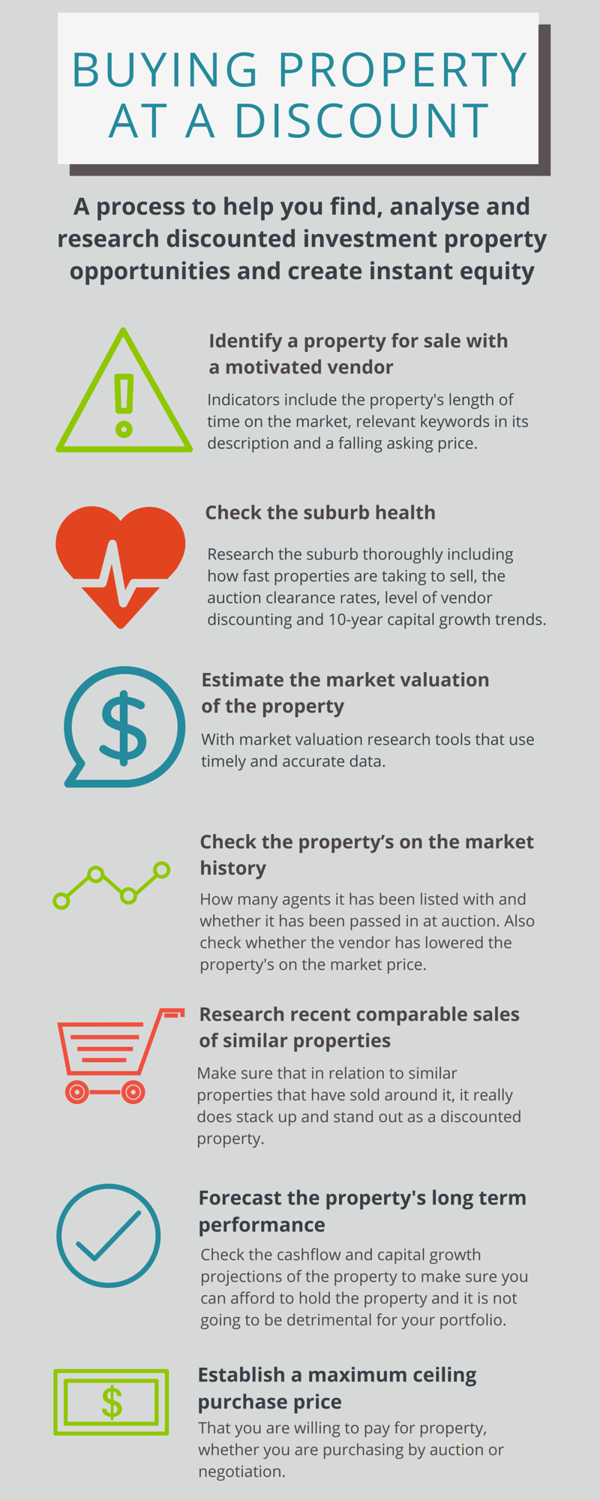

Research and due diligence are essential steps in identifying viable investment opportunities. This includes researching potential markets, neighborhoods, and property types, as well as conducting thorough financial analysis and feasibility studies. By carefully evaluating factors such as rental demand, property appreciation potential, and cash flow projections, investors can mitigate risks and maximize returns.

Investment Strategies

There are various investment strategies available to investors seeking to capitalize on property opportunities. From long-term buy-and-hold strategies to short-term flipping or rental arbitrage, each approach offers unique advantages and considerations. Investors should carefully consider their financial goals, risk tolerance, and investment timeline when selecting the most suitable strategy.

Investment Property Opportunities Abound

Investment property opportunities abound in diverse markets and property types. From residential properties like single-family homes and multi-unit apartment buildings to commercial properties such as office buildings, retail spaces, and industrial warehouses, there are opportunities to suit a wide range of investment preferences and objectives.

Financing Options

Financing plays a crucial role in unlocking investment property opportunities. Investors have various financing options available, including traditional mortgages, private lenders, crowdfunding platforms, and creative financing strategies. By exploring different financing avenues and leveraging available resources, investors can optimize their capital structure and maximize their investment potential.

Property Management Considerations

Effective property management is essential for maximizing returns and minimizing risks associated with investment properties. This includes tasks such as tenant screening, rent collection, property maintenance, and regulatory compliance. Whether managing properties independently or hiring professional property management services, investors should prioritize proactive management practices to ensure long-term success.

Market Timing and Timing

Timing can significantly impact the success of investment property opportunities. While it’s impossible to predict market fluctuations with certainty, investors can use market indicators and economic forecasts to gauge the timing of their investments. By entering the market at opportune times and capitalizing on favorable conditions, investors can enhance their chances of success and maximize their returns.

Networking and Relationships

Networking and building relationships within the real estate industry can open doors to valuable investment opportunities. This includes connecting with real estate agents, brokers, fellow investors, and industry professionals who can provide insights, advice, and access to off-market deals. By cultivating a robust network and fostering mutually beneficial relationships, investors can expand their investment horizons and uncover hidden gems.

Continuous Learning and Adaptation

The real estate market is constantly evolving, presenting new challenges and opportunities for investors. To stay ahead of the curve, investors must commit to continuous learning and adaptation. This involves staying informed about market trends, industry developments, and regulatory changes, as well as refining investment strategies based on evolving market conditions.

Conclusion

Investment property opportunities are abundant for investors willing to do their due diligence, think strategically, and take calculated risks. By understanding the market landscape, conducting thorough research, and leveraging available resources, investors can unlock the potential of real estate and build wealth over the long term. With the right knowledge, skills, and mindset, investment property opportunities can be a lucrative and rewarding venture for investors of all levels.