Evolving Condo Property Sales Trends: A Snapshot of Urban Living

The landscape of condo property sales is a dynamic one, offering a window into the ever-changing preferences and behaviors of urban dwellers. From emerging market trends to shifts in buyer demographics, understanding the dynamics of condo property sales provides valuable insights into the state of urban living.

Shifting Demographics in Condo Buyers

One of the key trends shaping condo property sales is the evolving demographics of buyers. Millennials, often drawn to the convenience and amenities of urban living, represent a significant segment of condo buyers. Their preferences for walkable neighborhoods, access to public transportation, and vibrant cultural scenes influence the types of condos being developed and marketed. Additionally, empty nesters and retirees seeking downsized, maintenance-free living are also driving demand for condos, particularly in urban areas close to amenities and services.

Condo Property Sales Trends Reflect Urbanization

The rise of condo property sales reflects the broader trend of urbanization, with more people choosing to live in dense, walkable urban areas. As cities continue to grow and expand, the demand for condos in central locations close to employment centers, entertainment districts, and transportation hubs remains strong. Developers are responding to this demand by building high-rise condominium towers and mixed-use developments in urban cores, offering residents a convenient, connected lifestyle.

Impact of Lifestyle Changes on Condo Sales

Changes in lifestyle preferences are also influencing condo property sales trends. As more people prioritize flexibility and convenience in their lives, condos are becoming an attractive option for both homeowners and renters. Condo developments with amenities such as fitness centers, coworking spaces, and concierge services cater to residents’ desire for a hassle-free lifestyle where everything they need is within reach. Additionally, the shift towards remote work and flexible schedules has increased interest in condos with dedicated home office spaces and communal work areas.

Sustainability and Green Living

Sustainability is becoming an increasingly important consideration for condo buyers, driving demand for environmentally-friendly and energy-efficient properties. Condo developments with green building certifications, such as LEED or ENERGY STAR, are attracting eco-conscious buyers who want to minimize their environmental footprint. Features such as energy-efficient appliances, green roofs, and electric vehicle charging stations appeal to buyers looking to live a more sustainable lifestyle.

Technology Integration in Condo Living

Technology plays a significant role in shaping the future of condo living and property sales. Smart home features, such as connected thermostats, keyless entry systems, and automated lighting, are increasingly common in new condo developments. These technologies not only enhance convenience and security for residents but also add value to properties. Additionally, developers are exploring virtual reality tours and digital marketing strategies to showcase condos to potential buyers, especially in markets where in-person viewings may be limited.

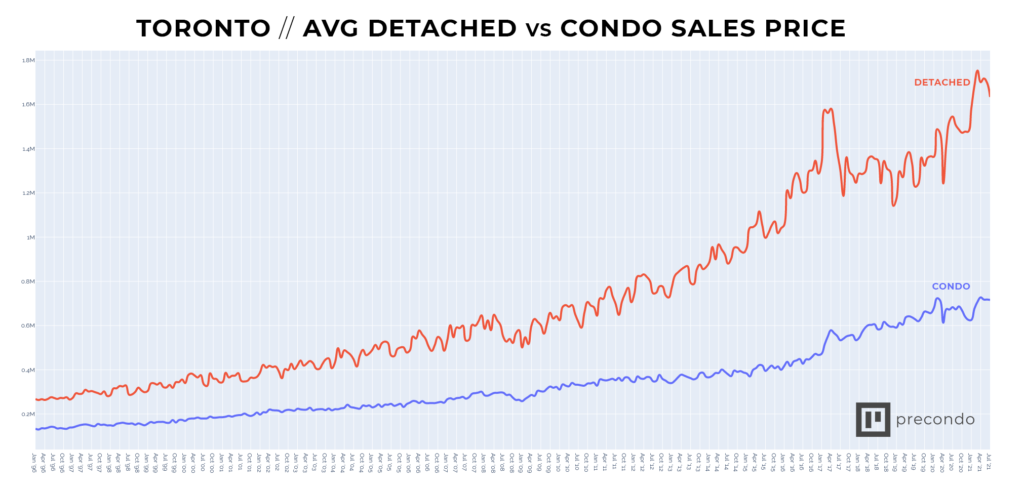

Pricing and Affordability Considerations

Pricing and affordability are important factors influencing condo property sales trends. In many urban markets, condos offer a more affordable entry point into homeownership compared to single-family homes. However, affordability challenges persist, particularly in high-demand cities where prices have risen