Understanding Your Financial Starting Point

Before you can build wealth, you need a clear picture of your current financial situation. This involves honestly assessing your income, expenses, assets, and debts. Create a budget to track your spending and identify areas where you can cut back. Knowing where your money is going is the first step towards controlling it and making it work for you. Consider using budgeting apps or spreadsheets to simplify this process. Don’t be afraid to seek professional financial advice if you’re feeling overwhelmed or unsure where to start. A financial advisor can help you analyze your situation and develop a personalized plan.

Setting Realistic Financial Goals

Once you understand your financial baseline, it’s time to set goals. What does financial freedom look like to you? Are you saving for a down payment on a house, planning for retirement, or hoping to pay off debt? Break down your large goals into smaller, achievable milestones. For example, instead of aiming for a million dollars in retirement, set a goal of saving a specific amount each month or year. Make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Having clear, well-defined goals will keep you motivated and on track.

Building a Solid Emergency Fund

Before you start investing or aggressively paying down debt, it’s crucial to build an emergency fund. This is a safety net for unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save 3-6 months’ worth of living expenses in a readily accessible account, like a high-yield savings account or money market account. Having this cushion will prevent you from going into debt during unforeseen circumstances and protect your long-term financial progress.

Strategic Debt Management

High-interest debt, like credit card debt, can significantly hinder your wealth-building journey. Develop a strategy to tackle your debt effectively. Consider methods like the debt snowball or debt avalanche methods. The debt snowball prioritizes paying off the smallest debts first for motivational wins, while the debt avalanche focuses on paying off the highest-interest debts first to save money in the long run. Explore options like debt consolidation or balance transfers to potentially lower your interest rates. Remember to avoid accumulating new debt as you work towards becoming debt-free.

Investing for Long-Term Growth

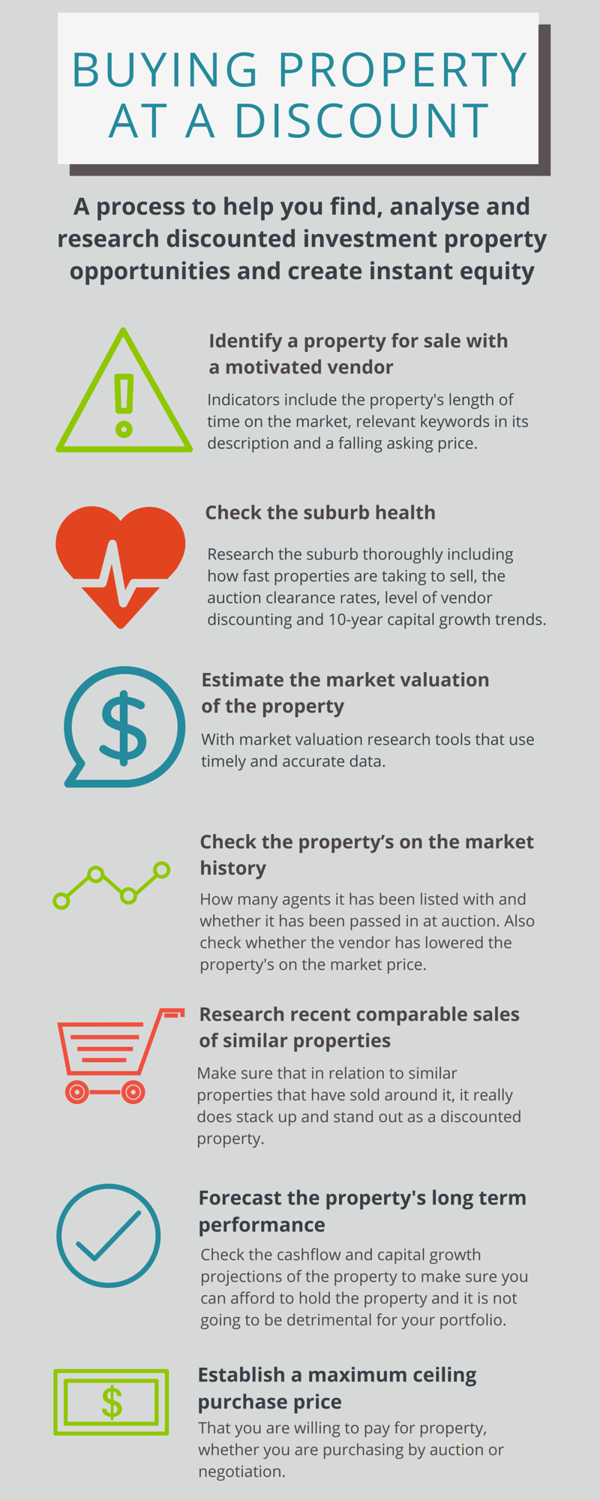

Investing is a cornerstone of building wealth. Start by understanding your risk tolerance and investment timeline. Long-term investors generally have a higher risk tolerance as they have more time to recover from market downturns. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk. Consider investing in low-cost index funds or ETFs to gain broad market exposure. Research different investment strategies and consider seeking advice from a financial advisor to determine the best approach for your individual circumstances.

Harnessing the Power of Compound Interest

Compound interest is the interest earned on your initial investment, plus the accumulated interest. It’s a powerful tool for wealth building, especially over the long term. The earlier you start investing and reinvesting your