Realty Excellence: Real Estate Brokerage Services

Real estate brokerage services play a pivotal role in the dynamic world of real estate transactions, serving as the bridge between buyers and sellers and facilitating smooth and successful transactions. From providing expert guidance and market insights to negotiating favorable terms and managing paperwork, real estate brokers offer a comprehensive range of services designed to streamline the buying and selling process and ensure client satisfaction.

Expert Guidance and Advice

At the heart of real estate brokerage services lies expert guidance and advice. Experienced brokers leverage their in-depth knowledge of local markets, trends, and regulations to provide clients with valuable insights and recommendations. Whether buyers are searching for their dream home or sellers are looking to maximize the value of their property, brokers offer personalized guidance tailored to each client’s unique needs and objectives.

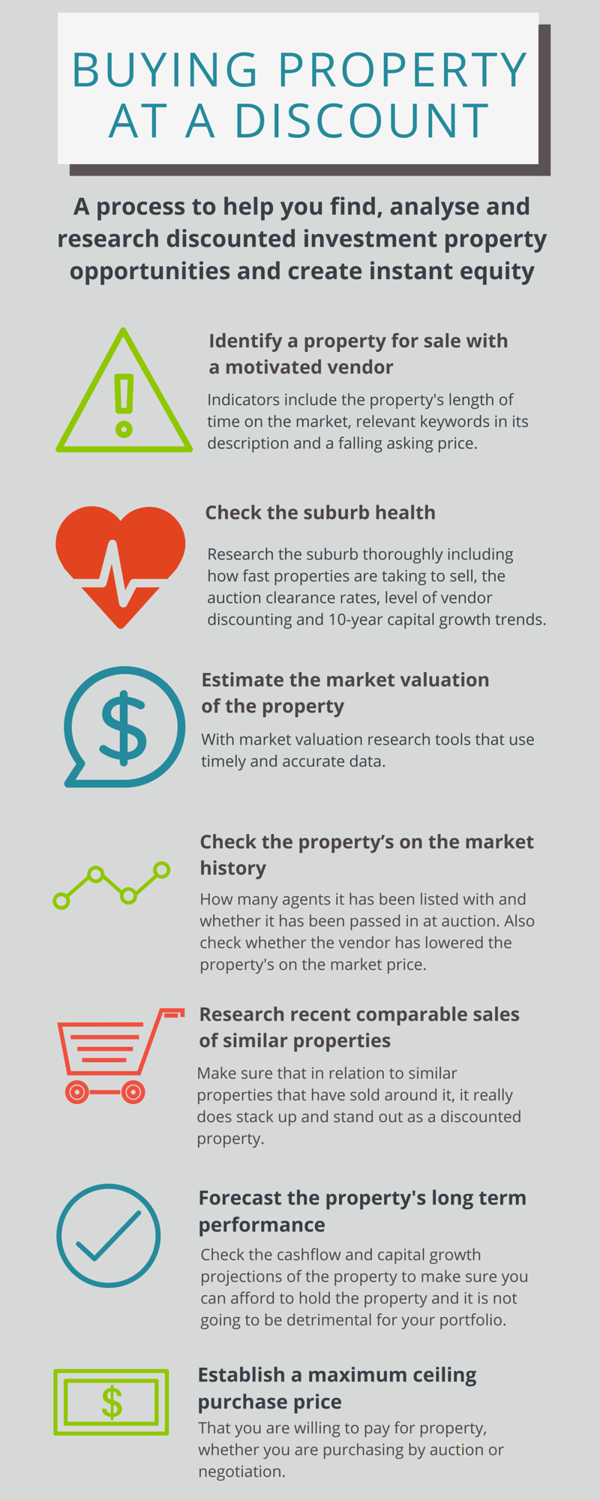

Market Analysis and Pricing Strategy

One of the key services offered by real estate brokers is market analysis and pricing strategy. Brokers conduct thorough market research to assess property values, analyze comparable sales data, and determine optimal pricing strategies. By accurately pricing properties based on current market conditions and buyer demand, brokers help sellers maximize their property’s value and attract qualified buyers.

Property Marketing and Promotion

Effective marketing and promotion are essential for attracting buyers and generating interest in properties. Real estate brokers utilize a variety of marketing channels, including online listings, social media, and traditional advertising, to showcase properties to a wide audience of potential buyers. By leveraging professional photography, virtual tours, and compelling listing descriptions, brokers create engaging marketing campaigns that highlight the unique features and benefits of each property.

Buyer Representation and Negotiation

Buyer representation is another key aspect of real estate brokerage services. Brokers act as advocates for buyers, helping them navigate the complexities of the homebuying process and negotiate favorable terms and conditions. From identifying suitable properties and scheduling showings to submitting offers and negotiating price adjustments, brokers guide buyers every step of the way to ensure a successful and satisfying purchase experience.

Seller Representation and Transaction Management

On the seller side, real estate brokers provide comprehensive representation and transaction management services. Brokers assist sellers in preparing their properties for sale, staging homes to maximize appeal, and creating marketing strategies to attract qualified buyers. Throughout the selling process, brokers manage all aspects of the transaction, from coordinating showings and responding to inquiries to negotiating offers and overseeing the closing process.

Legal and Contractual Expertise

Navigating the legal and contractual aspects of real estate transactions can be daunting for buyers and sellers alike. Real estate brokers offer valuable expertise in interpreting and navigating contracts, disclosures, and legal documents to ensure compliance with local laws and regulations. Brokers work closely with clients to explain complex terms and provisions, address any concerns or questions, and safeguard their interests throughout the transaction.

Transaction Coordination and Support

Real estate transactions involve numerous moving parts and deadlines that require careful coordination and attention to detail. Brokers serve as transaction coordinators, overseeing all