Revitalize & Profit: Exploring Fix-and-Flip Property Ventures

Understanding the Fix-and-Flip Strategy

The fix-and-flip strategy has gained popularity among real estate investors seeking to profit from buying distressed properties, renovating them, and selling them for a profit. This strategy involves identifying properties with potential, making strategic renovations to increase their value, and then selling them at a higher price. Understanding the fundamentals of the fix-and-flip strategy is essential for investors looking to embark on this lucrative venture.

Identifying Profitable Properties

One of the key aspects of the fix-and-flip strategy is the ability to identify properties with profit potential. This involves conducting thorough market research to identify areas with high demand and potential for appreciation. Additionally, investors must assess the condition of properties and estimate the cost of renovations accurately to determine their profit margin. By identifying properties that are undervalued or in need of renovation, investors can maximize their potential for profit.

Strategic Renovations for Maximum Value

Renovations play a crucial role in the success of a fix-and-flip project, as they can significantly impact the property’s value and marketability. Investors must prioritize renovations that offer the highest return on investment, focusing on upgrades that improve the property’s appeal and functionality. This may include updating kitchens and bathrooms, replacing flooring, painting walls, and enhancing curb appeal. By making strategic renovations, investors can maximize the property’s resale value and attract potential buyers.

Navigating the Renovation Process

The renovation process can be complex and challenging, requiring careful planning, budgeting, and execution. Investors must coordinate with contractors, suppliers, and other professionals to ensure that renovations are completed on time and within budget. Additionally, investors must navigate any unforeseen challenges or issues that may arise during the renovation process, such as permit delays or unexpected structural issues. By staying organized and proactive, investors can streamline the renovation process and maximize their chances of success.

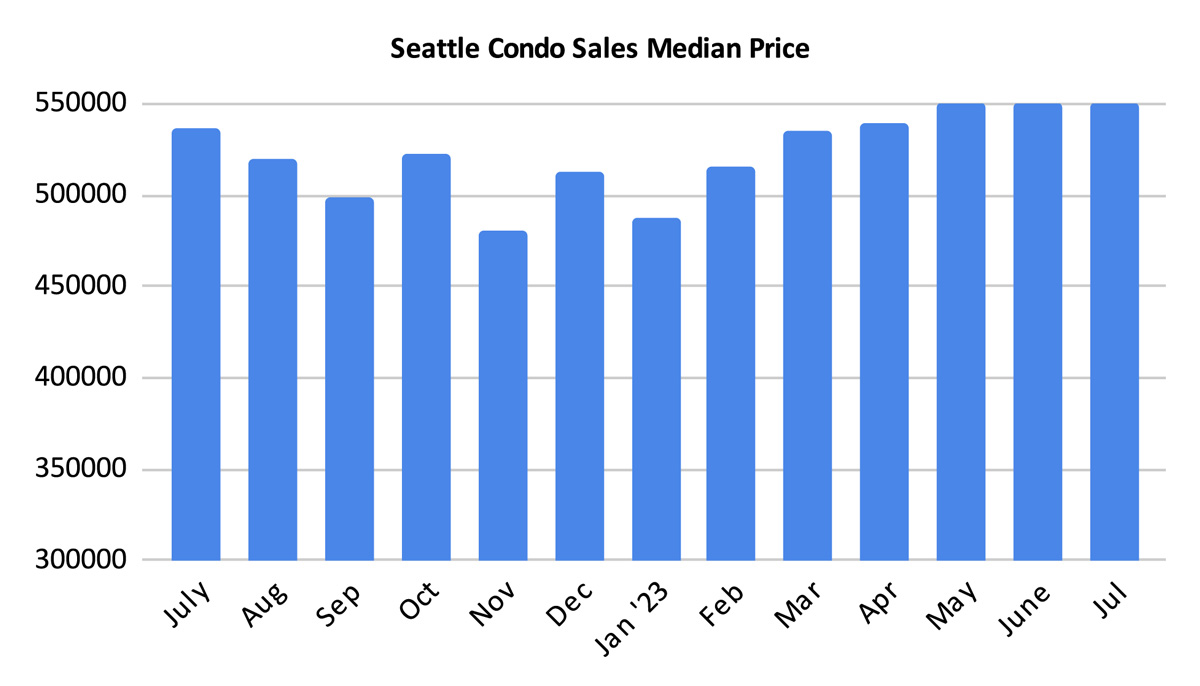

Timing the Market for Optimal Sales

Timing is crucial when it comes to selling a fix-and-flip property for maximum profit. Investors must carefully assess market conditions and determine the optimal time to list their properties for sale. This may involve waiting for market conditions to improve or strategically timing the sale to coincide with peak buying seasons. Additionally, investors must price their properties competitively to attract potential buyers while still maximizing their profit margin. By timing the market effectively, investors can capitalize on favorable conditions and maximize their returns.

Exploring Fix-and-Flip Properties

For investors looking to explore fix-and-flip properties and embark on their own renovation projects, Fix-and-Flip Properties offers a comprehensive resource and guide. With expert insights, renovation tips, and market analysis, Fix-and-Flip Properties equips investors with the knowledge and tools they need to succeed in the competitive world of fix-and-flip investing. Whether you’re a seasoned investor or new to the world of real estate, Fix-and-Flip Properties can help you navigate the complexities of renovation projects and unlock the potential for profit.