In the intricate realm of real estate transactions, real estate property agents serve as invaluable partners, guiding clients through the complexities of property transactions with expertise and dedication.

Navigating the Property Landscape: Expert Guides in a Dynamic Market

Real estate property agents are expert navigators in the dynamic landscape of property transactions. With comprehensive knowledge of local markets, regulations, and trends, they provide invaluable guidance to clients, helping them navigate the intricacies of buying, selling, or renting properties.

Tailored Support: Personalized Assistance for Every Client

One of the key strengths of real estate property agents is their ability to provide personalized support tailored to the unique needs and preferences of each client. Whether it’s assisting first-time homebuyers in finding their dream home or helping investors identify lucrative investment opportunities, agents offer customized solutions to meet the diverse needs of their clientele.

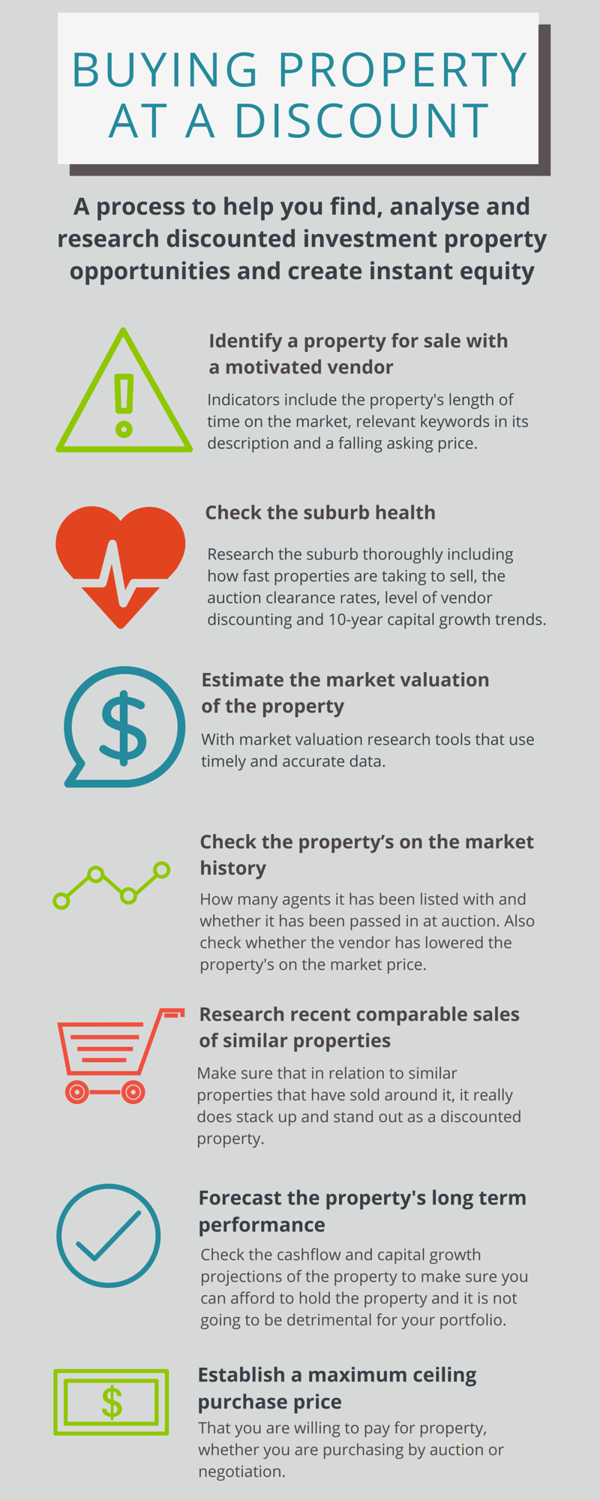

Market Insights: Leveraging Data for Informed Decision-Making

Real estate property agents harness their market insights and access to comprehensive data to empower clients with the information they need to make informed decisions. By analyzing market trends, comparable sales data, and economic indicators, agents provide clients with valuable insights into property values, market conditions, and investment opportunities, enabling them to make strategic decisions aligned with their goals.

Negotiation Mastery: Maximizing Value in Transactions

Negotiation is a critical aspect of any real estate transaction, and real estate property agents excel in this domain. Armed with negotiation expertise, agents advocate on behalf of their clients to secure favorable terms, maximize value, and overcome potential obstacles that may arise during negotiations. Whether it’s negotiating the purchase price, terms of the contract, or contingencies, agents work tirelessly to ensure their clients’ interests are protected.

Streamlining the Process: Efficient Transaction Management

Real estate transactions involve numerous moving parts, from coordinating inspections and appraisals to navigating the closing process. Real estate property agents play a central role in streamlining these processes, ensuring that transactions proceed smoothly and efficiently from start to finish. By managing timelines, communicating with stakeholders, and addressing any issues that arise, agents minimize stress and uncertainty for their clients.

Building Trust and Relationships: Partners in Property Success

Beyond their expertise and skills, real estate property agents prioritize building trust and nurturing relationships with their clients. By providing transparent communication, ethical guidance, and attentive support throughout the transaction process, agents cultivate long-term partnerships based on mutual respect and shared objectives. This focus on trust and relationships forms the bedrock for continued success and referrals in the real estate industry.

Real Estate Property Agents: To experience the expertise and dedication of professional real estate property agents, visit Real Estate Property Agents.